Help with Dynamic Currency Conversion (DCC)

Welcome to Dynamic Currency Conversion (DCC)

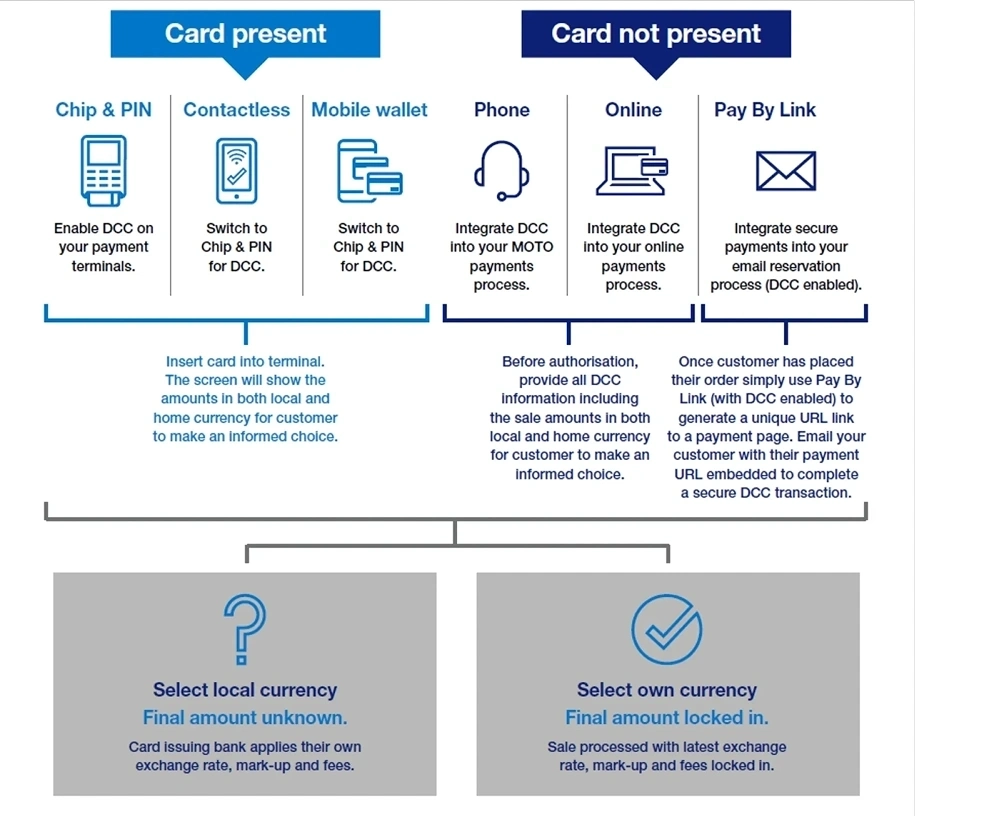

Dynamic Currency Conversion (DCC) is a service that enables international Visa®, MasterCard® and Diners Club® cardholders in over 80 currencies the choice to pay the bill in their own currency rather than the currency of the country that they are visiting.

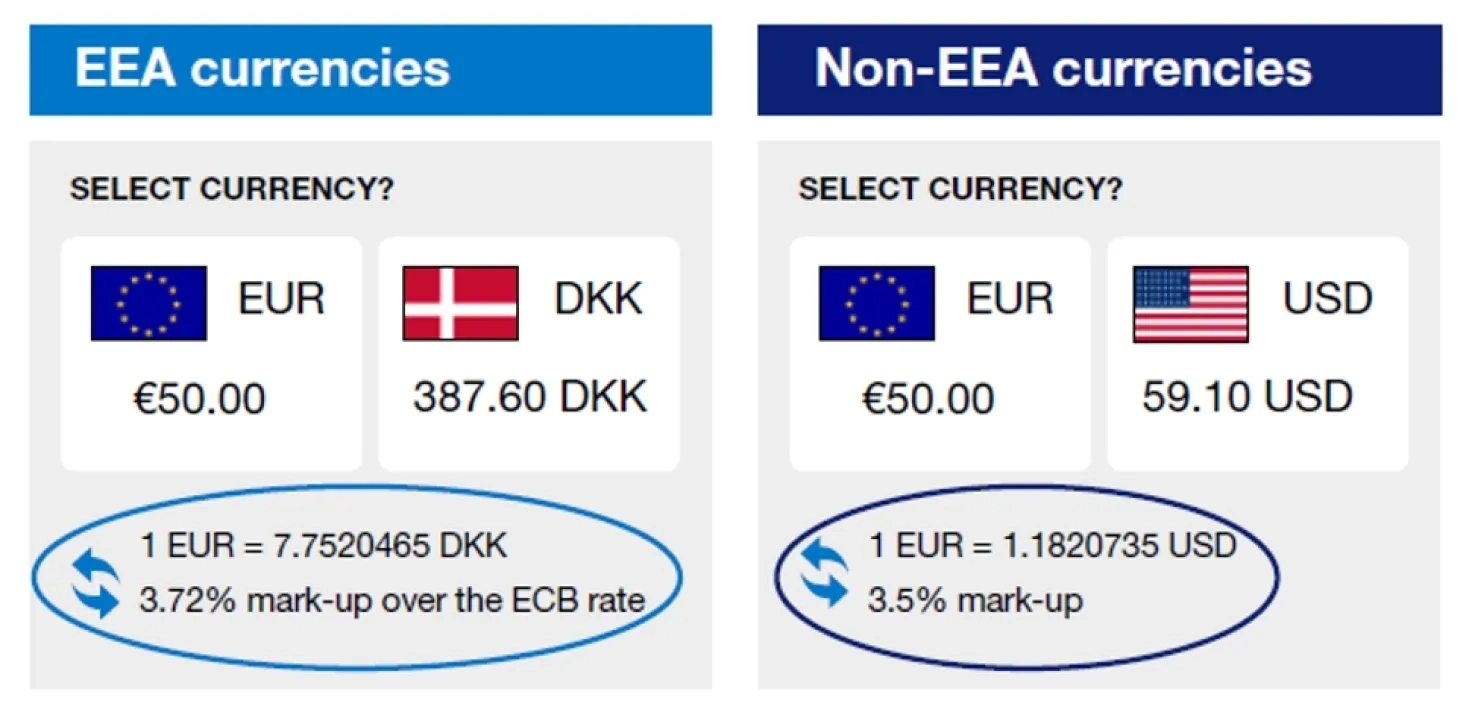

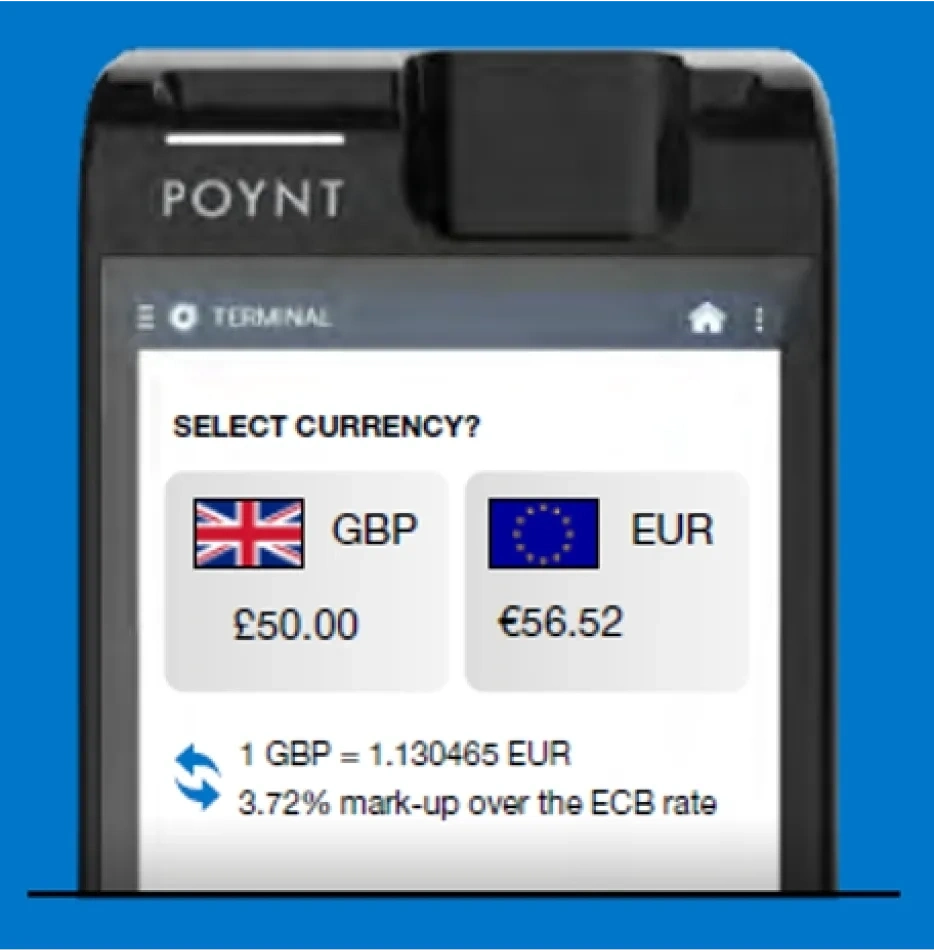

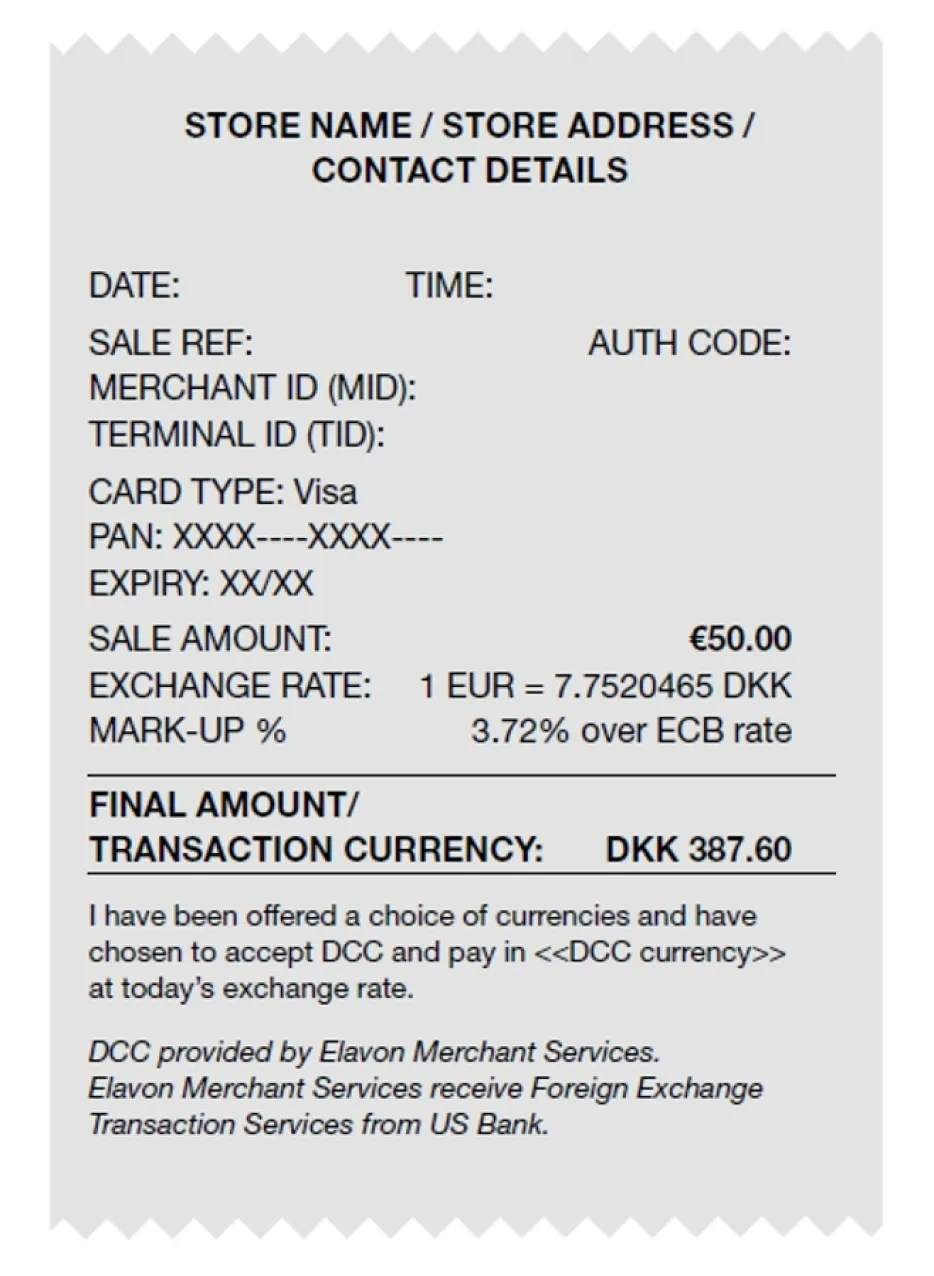

- Offer your international customers the ability to pay in their own currency. The receipt will show the amount in your currency, the customer's home currency and the conversion rate.

- Customers will know exactly what they're paying for at the time of sale including all charges so that they'll see the same amount on their card statement when they get home.

We will manage the entire conversion process for you: from direct treasury exchange rates and transaction processing to back-end reconciliation, settlement, funding, and support.

Accepting DCC means the cardholder accepts today’s Elavon exchange rate, including commission and knows the final price at the time of purchase as it is displayed on the card machine and their receipt.

Declining DCC means the cardholder’s bank will convert the transaction at a later date using its exchange rate, plus commission and any other charges. The cardholder may not know this final amount until they see their statement.